It started with a missed tax deadline.

Not a big one—just a quarterly filing that slipped through the cracks. The finance manager blamed the software: “It didn’t alert me.” The CEO, tired of last-minute scrambles and constant legal anxiety, called a meeting. On the whiteboard were three words: “We need help.”

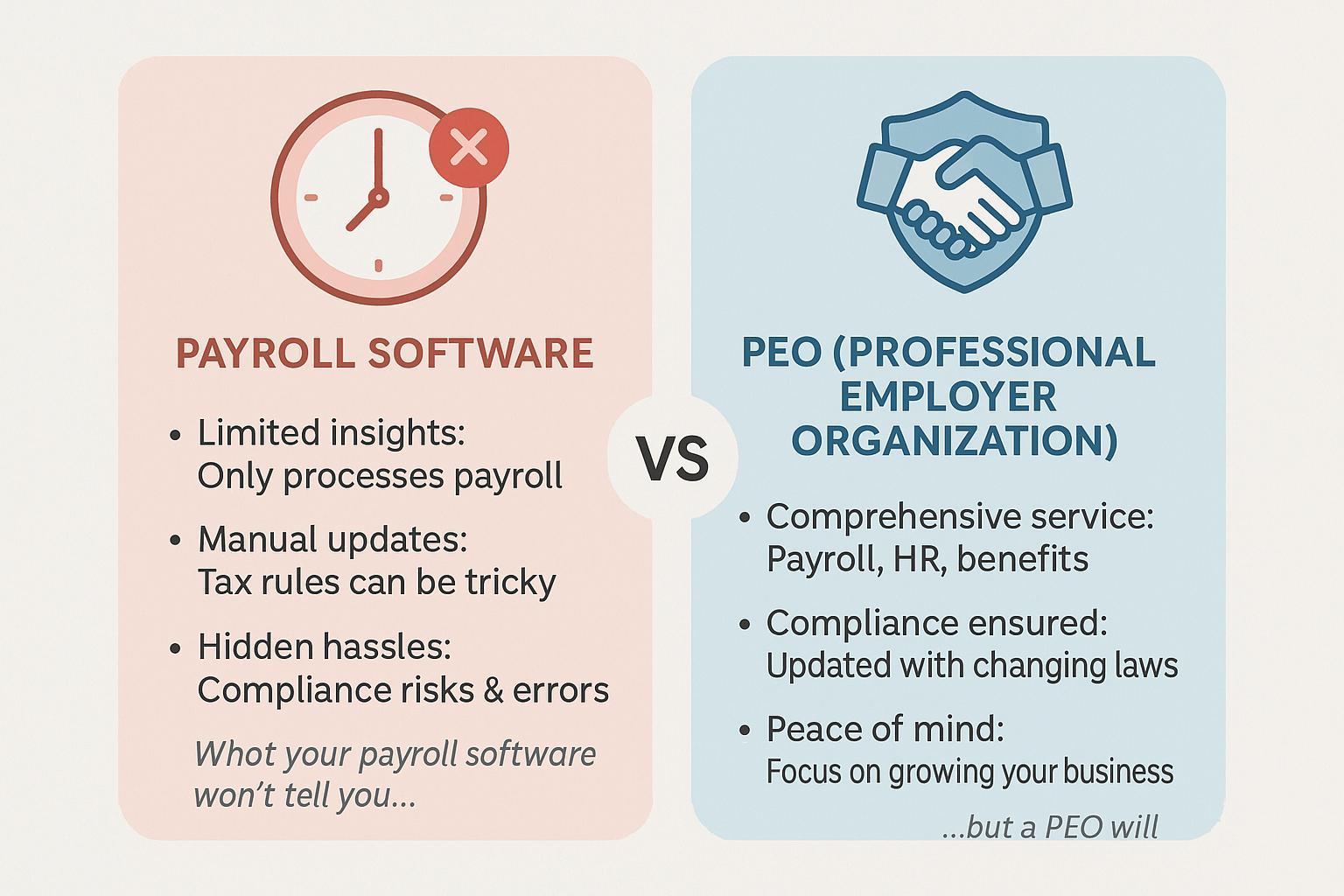

Like many growing companies, they had outgrown the convenience of their payroll software without realizing it. The platform they once celebrated for automating salaries and taxes had become a silent bottleneck. It handled numbers but ignored nuance. It knew dates but not regulations. It printed pay stubs but couldn’t solve compliance puzzles or provide HR strategy.

This wasn’t a software problem. It was a growth problem.

And it’s more common than most business owners realize.

The truth? Payroll software is built for management—not for mitigation. It’s reactive. It’s linear. And it’s just one piece of a puzzle that includes compliance risks, employee satisfaction, benefits administration, workplace safety, and people management.

So, while payroll software calculates, a PEO counsels.

This blog dives into the overlooked truths your payroll software won’t tell you—secrets that a good PEO knows by heart. Because payroll is just the start of the story… and your business deserves a better ending.

1. Payroll Software Focuses on Numbers, Not People

Payroll software is excellent at crunching data. It can process paychecks, calculate taxes, and generate W-2s. But what happens when an employee disputes overtime hours? Or when a team member goes on extended leave under FMLA? Software can’t mediate, interpret legal nuances, or anticipate human concerns.

A PEO brings a human touch to HR and payroll. It comes with experts who understand both the emotional and legal dimensions of employee management. Whether it’s compliance with federal leave laws, dealing with misclassification risks, or setting up fair employee policies, a PEO offers holistic support that software can’t.

Example: If you run a business in multiple states, your payroll software may not account for nuanced regional laws. A PEO, however, is built to manage multi-state compliance seamlessly

2. Compliance Isn’t Optional—But Payroll Software Treats It Like It Is

Did you know that according to the IRS, 33% of employers make payroll errors, and penalties for noncompliance can run to thousands of dollars per year? Most payroll software tools send alerts—but they don’t assess risk or offer strategic responses.

A PEO acts as a compliance partner. It monitors laws, updates document, trains your team, and ensures every form is filed on time and correctly.

Key Areas Covered by PEOs:

ACA compliance

Employee classification (W-2 vs. 1099)

Wage and hour laws

State-by-state employment laws

COVID-19-related leave policies (now winding down, but still relevant in audits)

3. Payroll Software Isn’t Designed for Strategic Growth

Your payroll software can’t help you analyze turnover, forecast hiring needs, or strategize your benefits packages to attract top talent. A PEO can.

A PEO provides data-backed insights into HR trends. It helps you create workforce plans, build retention strategies, and benchmark compensation packages. Payroll software sees transactions; a PEO sees trends.

Strategic Insights from PEOs Include:

Turnover risk modeling

Employee engagement surveys

Compensation benchmarking

Talent acquisition support

4. Payroll Software Doesn’t Reduce Liability—It Outsources Responsibility

Many business owners assume that using software means they’re covered legally. Not true. Payroll errors, wrongful terminations, and poor documentation still leave the business fully liable.

PEOs often operate under a co-employment model. This means they share certain legal responsibilities with you—essentially becoming a partner in protecting your business. They help with:

Claims management

Risk mitigation training

Workplace safety protocols

5. PEOs Offer Access to Big-Business Benefits

Small businesses using payroll software alone often can’t access affordable healthcare, 401(k) plans, or wellness programs. PEOs pool multiple clients to negotiate better benefits at lower costs. You become part of a bigger bargaining unit.

Benefits Administered by PEOs:

Medical, dental, vision insurance

401(k) retirement plans

Life and disability insurance

Employee wellness programs

This results in happier employees and improved retention.

6. Payroll Software Has No Face

When issues arise—like a wage garnishment notice, a harassment complaint, or an emergency leave—who do you call? Most payroll software companies route you through chatbots or low-tier customer service reps.

With a PEO, you get dedicated specialists—real people who know your business and guide you through difficult situations. From HR advisors to legal counsel, they don’t just troubleshoot—they protect.

Real Business Case: Sequoia’s Data Breach

In late 2022, Sequoia, a payroll and HR platform, experienced a major data breach. Employee names, addresses, social security numbers, and more were exposed. This highlighted a crucial truth: software is vulnerable.

A good PEO invests in layered security systems, data redundancy, and crisis communication plans. And more importantly, they walk you through recovery—not leave you to read help articles.

Conclusion

Payroll Software Is a Tool. A PEO Is a Partner.

Your payroll software can cut checks and calculate taxes. But it can’t:

Anticipate risk

Guide leadership decisions

Offer employee counseling

Provide legal defense

Help you grow strategically

A PEO does all of that—and more.

So, here’s the big question: Is your business growing faster than your software can keep up with?

If yes, maybe it’s time to look beyond automation… and lean into partnership.

References

- Business.com – Surprising Perks of PEOs

https://www.business.com/articles/surprising-perks-peos/

- ExtensisHR – PEOs and Risk Management

https://extensishr.com/resource/blogs/peos-and-risk-management/

- Paycor – Pros and Cons of Using a PEO

https://www.paycor.com/resource-center/articles/pros-and-cons-of-using-a-peo-company/

- US Chamber – PEOs vs Payroll Services

https://www.uschamber.com/co/co-100

- Wired – Sequoia Data Breach

https://www.wired.com/story/sequoia-hr-data-breach/

- APSPayroll – Talk PEOs: Pros & Cons

https://apspayroll.com/blog/talk-peos-pros-cons/

- EmployBorderless – Payroll Systems

https://employborderless.com/payroll/systems/