Because no policy is still a policy… and it might cost you more than you think.

When startups scale, speed often becomes a double-edged sword. You boarded fast. Filled in gaps. Trust your gut. Hope for the best. But now the honeymoon phase is over. A recent hire isn’t performing. There’s tension. Productivity is dropping. Your team is frustrated. And you’re ready to let them go. But wait—do you have:

- Documentation of their performance issues?

- A signed employee handbook?

- Proof of consistent treatment across all employees?

- A compliant termination process?

If not, you’re not just firing wrong—you’re firing dangerously.

The Compliance Cost of “Wing It” Off boarding

Terminating an employee without proper HR processes opens the door to claims of:

- Wrongful termination

- Discrimination

- Retaliation

- Hostile work environment

In fact, wrongful termination lawsuits have been increasing steadily. Most small businesses don’t think this could happen to them—until it does.

What You Thought Firing Would Look Like:

- Quick meeting

- Professional goodbye

- Moving forward

What It Can Actually Look Like Without HR Support:

- A formal demand letter

- Legal consultations

- Public reviews and damage contro

- Burned out internal teams

- Massive payouts

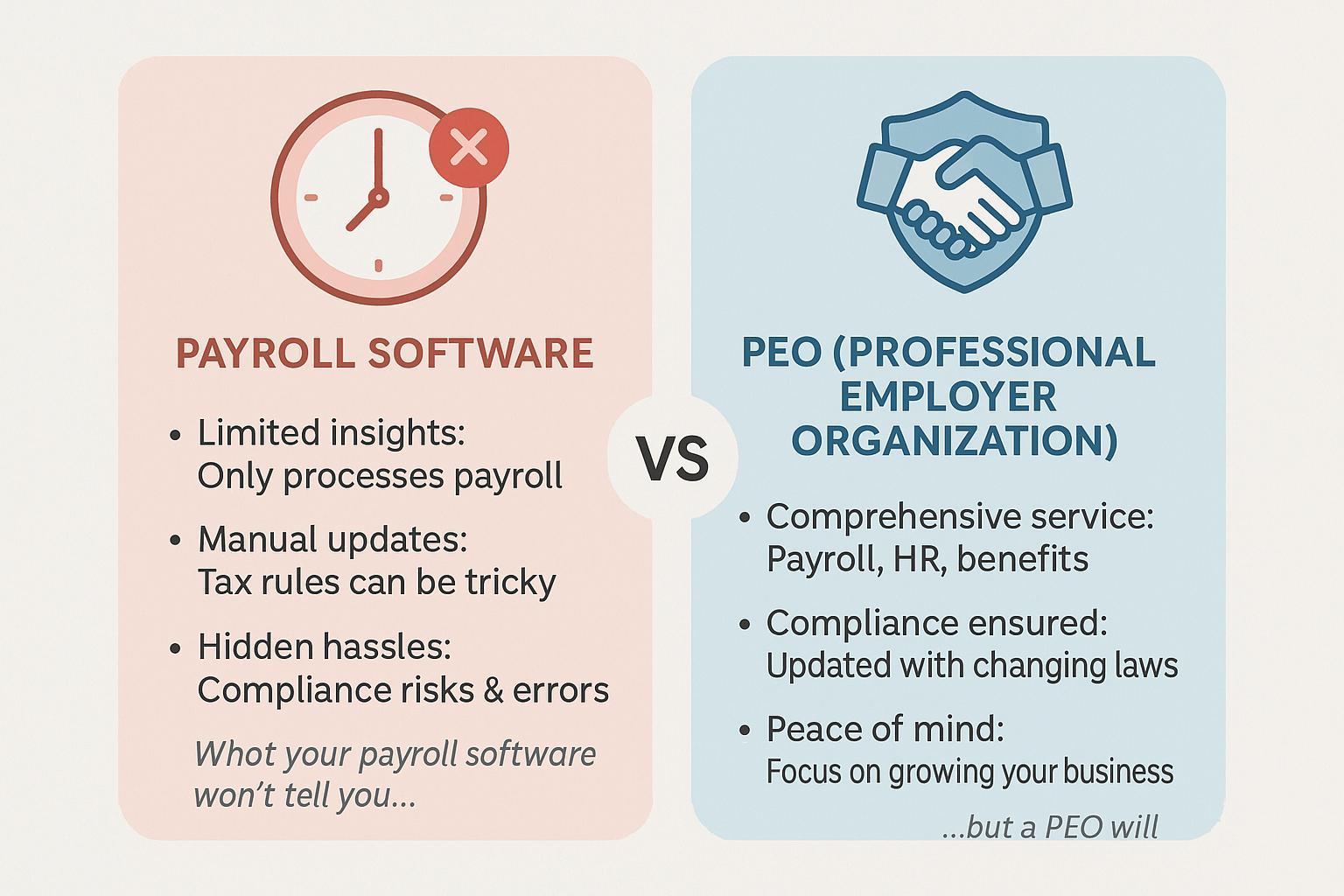

Enter the PEO: Your HR Safety Net

A Professional Employer Organization (PEO) doesn’t just help with hiring. It gives you the legal and structural backbone to exit an employee legally, fairly, and with minimal risk. Here’s what that looks like:

Documented Performance Reviews

PEOs help establish performance management systems that track:

- Goals set and missed

- Feedback delivered

- Actions taken

- Warnings issued

No guesswork. Just clear records.

Termination Protocols

From verbal warnings to final separation, PEOs create standardized procedures aligned with labor law and state-specific compliance rules.

Legal Support On-Call

If a situation gets tricky, PEOs provide:

- Immediate HR guidance

- Legal review of documentation

- Support during difficult exit

Think of it as your HR pit crew—handling the friction, so your business keeps moving.

The Real Cost of Getting It Wrong

According to SHRM, the cost of one wrongful termination lawsuit—even if you win—can range from $75,000 to $125,000 in legal fees and productivity loss. Worse, it’s not just about one employee. The morale hit, reputational damage, and internal tension can ripple across your team

PEOs Prevent These Scenarios by Design

Instead of reactive HR, you get proactive protection:

- Pre-written policies

- Documented performance systems

- Legal compliance checkpoints

- Strategic workforce planning

- Conflict de-escalation mechanisms

You’re no longer just “firing” someone—you’re managing risk the right way.

Firing Isn’t the Problem. Unstructured Offboarding Is.

Letting go of someone who doesn’t fit is sometimes the right move. But how matters as much as the why. And if you’re growing, the stakes are too high to keep guessing your way through terminations. So, before your next hire becomes your next HR nightmare, ask:

“Are we protected if this doesn’t work out?” If the answer is no, it’s time to bring in a PEO.

References:

- EEOC Enforcement Statistics:

https://www.eeoc.gov/statistics/charge-statistics-eeoc-fy-1997-through-fy-2022

SHRM: Managing the Risks of Termination:

https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/managing-the-risks-of-termination.aspx

NAPEO: PEO Industry Impact Research:

https://napeo.org/what-is-a-peo/peo-industry-statistics

Harvard Business Review: HR Mistakes in Businesses:

https://hbr.org/2020/09/the-right-way-to-scale-your-team